From time to time, taking out a personal loan can be a useful way of securing extra funds for various purposes. From emergency medical expenses to cover the costs of home renovations, there are many valid reasons why consumers borrow money in this way. With the low rates offered by many lenders these days, it is no wonder that personal loans are on the rise.

However, taking out a personal loan is not something to be considered lightly. If you are not prepared with the right information, you could find yourself stuck in an uncomfortable debt situation. To feel at ease you may visit King Of Kash to learn more about personal loans and the requirements you might need for your loan application. Taking the time to research your finances and understand the loan that you want to take out is significant.

To make the process a bit easier for you, let’s look at three specific things that you need to consider before applying for a personal loan.

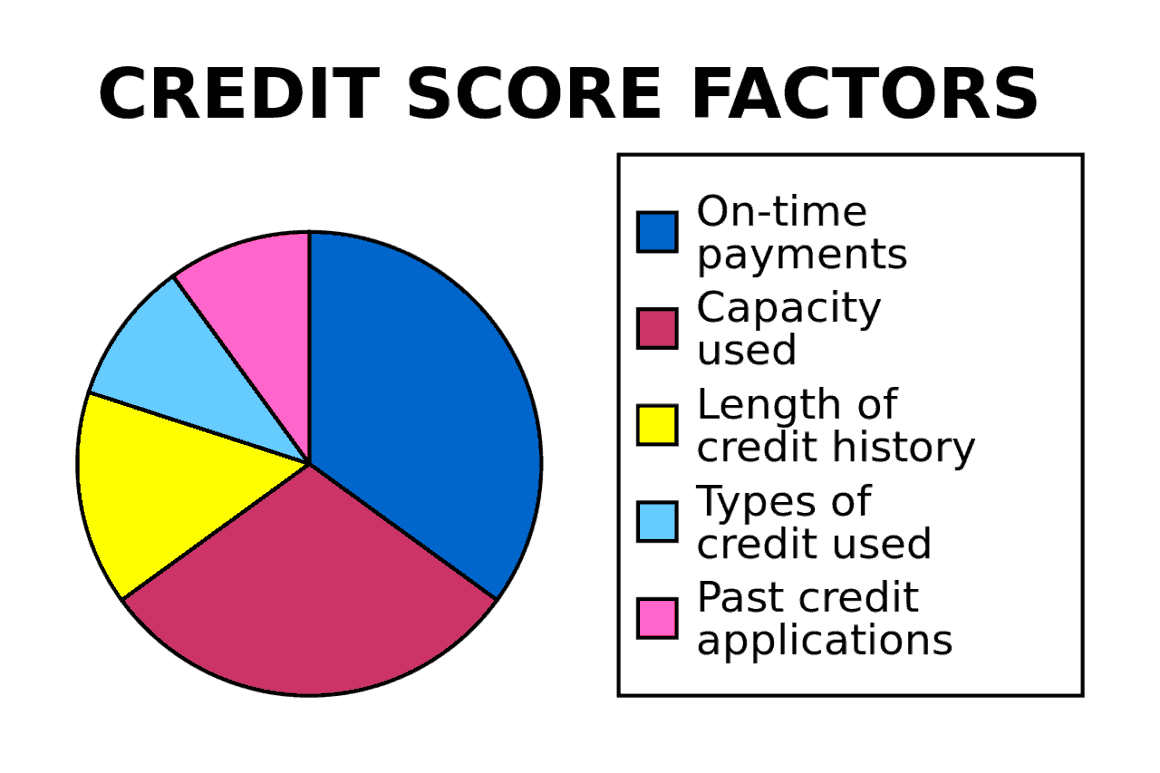

Know your credit score

If you are in the dark about your credit rating, then applying for a personal loan will be a much more difficult process. By seeking out this information for yourself ahead of time, you will have a much better idea of what kind of rates that lenders will be willing to offer you. You can check out the current rates if you click this site. You will also have realistic expectations about how your lenders will treat you when you know what information they will be used to make their determination.

If you have a good credit score, then knowing this ahead of time will also give you a bargaining chip when negotiating your rate. Those with good credit can be confident that they can likely secure a loan with many lenders, and so if one particular financial institution wants your business, you can bring up this reality.

Know your monthly budget

Before you take out a personal loan, you need to have a good idea of how much money you would like to borrow, which you probably already know. Taking this number and your estimated interest rate, you can quickly determine your average monthly payments to repay the loan.

Setting a budget is a wise financial practice, but it is essential to add more debt to your finances. Knowing how much you can afford to pay back each month and maintain a reasonable lifestyle is important. Take your budget and take the estimated monthly payment that you have calculated to ensure that the prospective personal loan you are considering is feasible for you.

Know why you need a personal loan

Personal loans have many useful and legitimate uses. However, lenders often provide this extra money even if the borrower does not have a specific reason or use for the extra funds. If you want to pay your monthly lifestyle expenses with a personal loan, then think again.

To remain in good financial health, it is important to know precisely why you need a personal loan in the first place. Things like home renovations are costly and often will be more expensive than monthly incomes can cover. In these cases, you have the confidence that the added value to your home will pay back the interest for you (in the long run). However, using a personal loan to buy expensive meals or other unnecessary discretionary spending is extremely unwise. The interest you will have to pay will quickly show you why this is an error.

Carefully consider a personal loan

Personal loans are great for many purposes. However, it would be best to use caution and good judgment before adding any new debt to your household budget. Consider the points here, and you will put yourself in the best position to use a personal loan effectively.