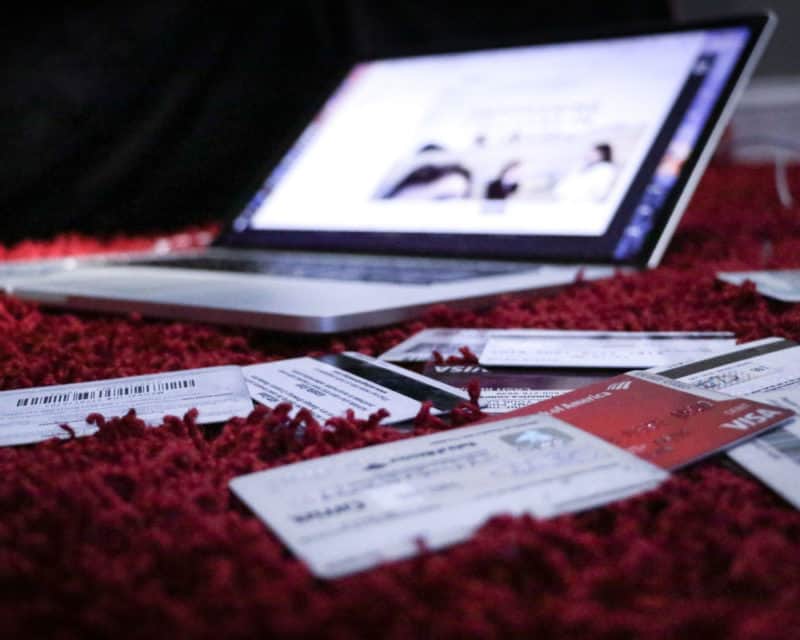

Sometimes bills pile up, the car breaks down, or other unnecessary expenses threaten to empty your bank account before payday. In these cases and more, a payday loan can be just the ticket to give you enough cash to hold you over until your next check.

But what if you have bad credit? Turns out, you can still get a payday loan with bad credit; let’s break down this process now.

- Compare all available payday loans

- Download/fill out loan applications

- Upload all necessary documents

- Wait for a response from your lender(s)

Compare all available loans

Payday loans with bad credit are everywhere. But you should compare them carefully, as many of them come with extra fees or pitfalls that can make them bad choices.

For example, you should consider these factors when applying for a loan:

- The credit score requirement. Try to find a loan with the highest credit you qualify for, as these usually have the best terms.

- The APR or interest rate. The higher the interest rate, the more money you’ll have to pay on the loan when you get your next paycheck. According to CNBC, the typical payday loan APR is over 600%!

- Fees, like application fees or late fees. These fees can really eat into your bank account and may defeat the purpose of your payday loan overall.

Lots of payday loans are traps for folks trying to make it from paycheck to paycheck. These loans then become additional debts that need to be paid off with the snowball method or some other repayment strategy. Don’t fall for these tricks, and try to choose the best payday loan you can.

Download/fill out loan applications

Once you’ve selected a payday loan, download any necessary documents or fill out the loan application if you can visit the lender branch in person. The application will require some personal information, like:

- Your Social Security number

- Proof of your place of employment (so they know you can repay the loan)

- Your address

Provide all this information as accurately as you can – it’ll improve your chances of getting approved for the loan.

Upload necessary documents

Next, upload or turn in those documents to the lender. We highly recommend trying to find a payday loan lender that doesn’t charge an application fee. You’ll save money when turning these documents in, and you won’t stretch your already tight budget further than it can go.

Wait for a response from the lender(s)

Once you’ve done all that, all that’s left is to wait for a response. Many of the best payday loan lenders will “prequalify” you for a loan, meaning they’ll take a look at your credit score with a soft credit check. They’ll be able to tell you whether you have a good chance of getting approved for the loan before applying.

Most payday loan lenders will approve you for your loan in a matter of minutes, especially if you apply online. Depending on the loan you choose, you could get your cash within 24 to 48 hours or even faster.

Remember – you have to pay back your payday loan ASAP or you’ll risk paying much more in interest!