Today, I want to chat about something close to my heart: teaching our teens about financial literacy. It’s not just about numbers and budgets; it’s about preparing them for the real world. And let’s be honest, it’s a topic we often sidestep, right?

Pocket Money and Practical Learning

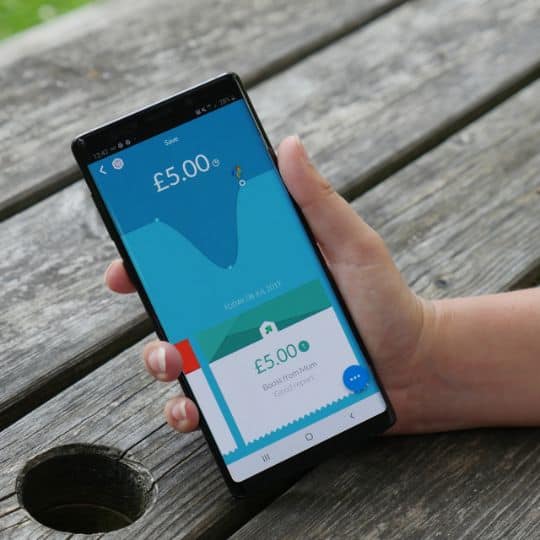

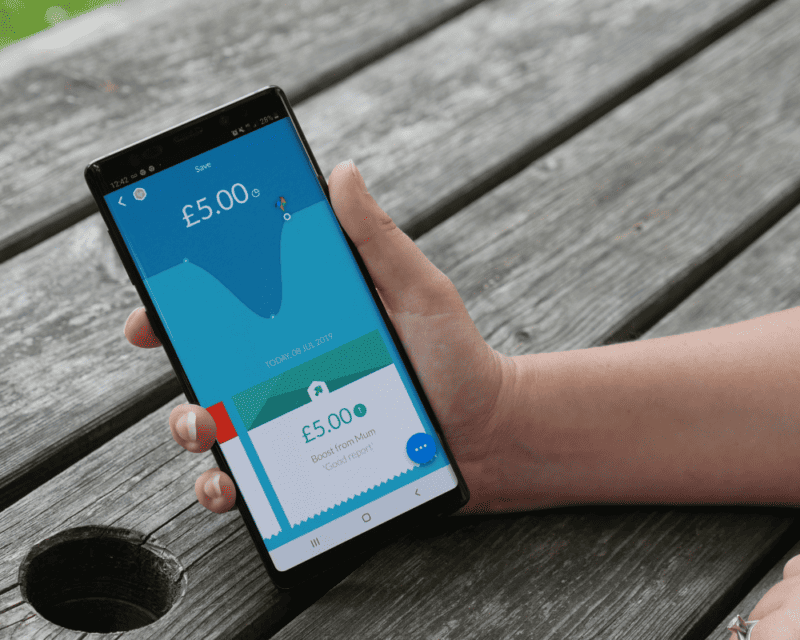

First off, let’s dive into the world of pocket money. In our home, we’ve rolled out the Rooster Card and its accompanying app for Lillie, Ollie, and Albie. And let me tell you, it’s been nothing short of revolutionary!

Introducing the Rooster Card was our way of giving the kids a taste of financial independence but within a controlled environment. The app isn’t just a tool for them; it’s a digital learning playground. They each have their own accounts, and it’s incredible to see how differently they approach their finances. Lillie, being the eldest, is a bit more calculated in her spending, often pondering over each purchase. Our middle child, Ollie, is the saver – always looking at the bigger picture and planning for something grand – usually a Lego purchase or his latest pair of Nike trainers! And Albie is still learning the ropes, often tempted by immediate pleasures but gradually understanding the value of waiting. It’s not unheard of for him to declare “money isn’t everything”.

The beauty of the Rooster Card is in its real-time nature. Every time they spend or save, they see their balance update immediately. This immediate feedback is crucial – it’s teaching them that every transaction has an impact, however small. It’s not just about saving up for the big things; it’s also about understanding the cost of the little indulgences.

But here’s the real kicker: they’re learning to negotiate and prioritize. The other day, Albie was torn between a Funko pop and a book. Watching him weigh his options, discussing the pros and cons, and finally making a decision was a proud parent moment. He decided that in the grand scheme of things, he didn’t really want either and so would save it for a bigger purchase down the line. These are the practical skills and decision-making processes they don’t teach in school.

And let’s not forget about the rewards system. The kids earn their pocket money through chores and tasks. It’s not just about handing them money; it’s about teaching them the value of hard work. They have tasks they have to complete each week to get their basic pocket money (a clean and tidy bedroom), but they can do additional chores like the dishwasher, laundry and vacuuming for extra money. When they buy something with the money they’ve earned, the satisfaction on their faces is priceless. It’s teaching them a fundamental life lesson: good things come to those who work for them.

So, I can’t recommend the Rooster Card enough for parents wondering about introducing a financial management tool to their kids. It’s more than an app or a card; it’s a stepping stone towards financial savvy for children.

Learning Through Experience

A couple of years back, we embarked on a significant journey as a family – extending our beloved family home. This wasn’t just any project; it was a venture that brought us all together in unexpected ways, especially when teaching the kids about finances.

Here’s the thing about big projects: they come with big price tags. And this was our perfect opportunity to involve Lillie, Ollie, and Albie in the financial side of such a venture. We sat down as a family and went over the costs, not sparing the details. It was important for them to understand that big dreams come with big responsibilities. It also helped them to understand why things like trips to the cinema, days out and pizza night might have to go on hold for a while.

But here’s where it gets interesting. It wasn’t just about showing them numbers and talking about expenses. We turned it into a hands-on experience. Each child had a role in designing their new rooms, which meant they also had a part in funding it. Now, we weren’t expecting them to cover the major costs, of course, but we wanted them to contribute in some way – to feel a sense of ownership and accomplishment.

So, we came up with a plan. Each kid was tasked with decluttering their old room and deciding which items to sell. You should have seen them going through their toys, clothes, and books, determining what to keep and what could find a new home. It was more than a cleaning exercise; it was a lesson in letting go and valuing what they have.

This experience taught them the value of money, but it also taught them about contribution, teamwork, and the satisfaction of earning. They learned that money isn’t just something you receive; it’s something you work for and requires planning and decision-making.

In the end, when the extension was completed and they saw their new rooms – partly funded by their efforts – the look of pride and accomplishment on their faces was something I’d never forget.

Open Conversations and Personal Experiences

Now, I’m pretty open about money with my kids. I’ve made my fair share of financial blunders and believe in sharing these lessons. It’s about honesty and transparency. When I talk to Lillie, Ollie, and Albie about my past mistakes, they understand that money isn’t just about spending; it’s about making choices, sometimes tough ones.

I’ve adopted a ‘save, then spend’ approach. This philosophy is something I’m passionate about passing on to my children. It’s not just a financial strategy; it’s a life lesson in self-control and planning. We’ve had many kitchen table discussions about the difference between ‘want’ and ‘need’ and how delaying gratification can lead to greater rewards.

Last year, when I saved enough to buy a new car, the kids saw firsthand the value of patience and hard work. It wasn’t just a new car but a symbol of dedication and smart planning.

Tools of the Trade

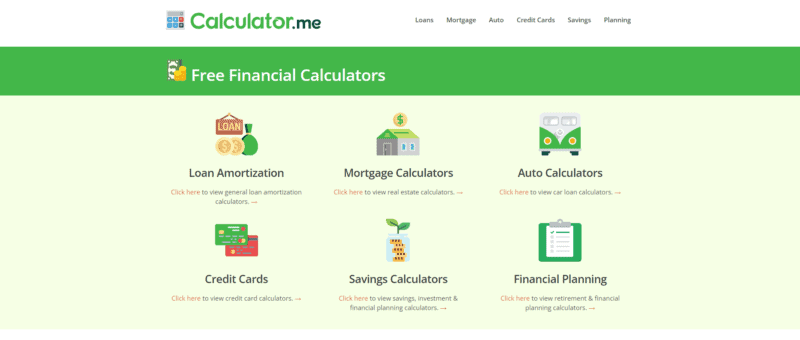

Managing finances, whether for the family or my business, requires more than good intentions. It needs the right tools. And that’s where Calculator.me has become a go-to resource. It’s like having a financial planner at my fingertips, one that’s accessible anytime I need it.

Their savings calculator? An absolute lifesaver. It’s not just about crunching numbers; it’s about visualising goals and mapping out a clear path to reach them. When I sit down with my laptop, cup of tea in hand, and start plugging numbers into that calculator, it’s not just a routine task. It’s a moment of clarity where abstract figures transform into concrete plans.

Moreover, I’ve been using their other calculators for my business. The budgeting calculator, for instance, has been a game-changer. It helps me keep track of my expenses and income, ensuring my blogging business stays financially healthy. It’s empowering to have such tools at my disposal, making what could be a complex process straightforward and manageable.

Inspiration and Tools for the Journey

I want you to feel inspired to have these conversations with your children. Discuss plans, dreams, and, yes, the realities of finance. And don’t forget, tools like Calculator.me can be invaluable allies in this journey. They’re not just calculators but stepping stones to understanding and empowerment.

Remember, teaching our kids about money is one of the most practical life lessons we can offer. It’s about setting them up for success, for a future where they’re in control of their finances, not the other way around.