Are you passionate about sports and looking for a way to make your passion into a profitable business venture? Sports stakeholders across the world understand that to maximize success, they need to invest intelligently and strategically. If you’re ready to take control of your investing strategies or if you’re just getting started in the sports industry world, our guide offers practical pointers on how to develop effective investment plans. Learn how successful investments can ensure prosperous gains while reducing risk in this comprehensive step-by-step guide covering the entire workflow process.

Identifying the Right Investment Opportunities

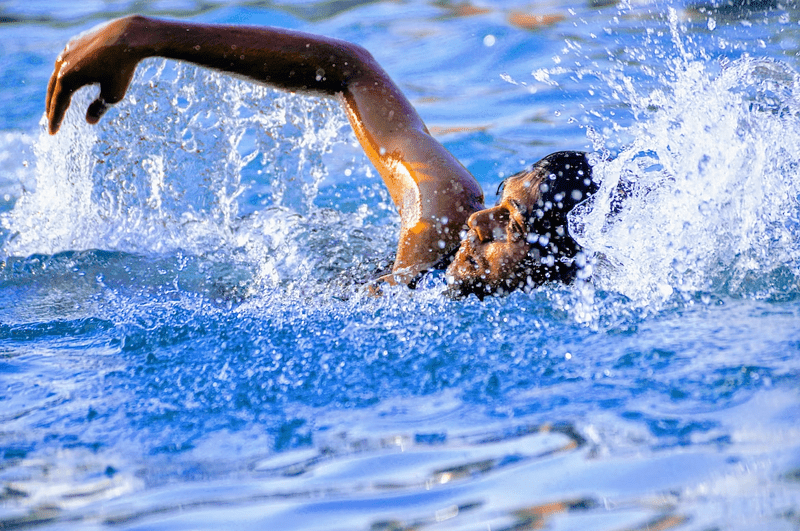

As the sports industry continues to grow, identifying the right investment opportunities has become increasingly crucial. With so many opportunities available, it can be easy to become overwhelmed and make hasty decisions. However, taking the time to thoroughly research and analyze potential investments can make all the difference in achieving success. It’s important to consider factors such as market demand, financial stability, and growth potential. For instance, if you are looking at investing in kids’ swimming schools, you should find more information about starting a Swim School franchise. This will allow you to gain insight into the specifics of running a swim school business and help you decide if it’s the right fit for your investments. Investors should also stay up-to-date on current trends and innovations in the industry to stay ahead of the game. By thoughtfully assessing opportunities and staying informed, businesses can make informed decisions and find success in the dynamic and ever-evolving sports market.

Assessing the Risks vs Rewards

As with any investment, weighing the potential reward against the inherent risks is crucial before committing your hard-earned money. The world of sports is no exception. On the one hand, investing in sports can potentially yield high returns, with major sporting events like the Olympics or World Cup drawing massive audiences from around the globe, leading to increased advertising revenues and sponsorships for teams and athletes. On the other hand, investing in sports is not without its risks. From injuries to scandals to sudden changes in the political landscape, the sports world can be unpredictable, leaving investors potentially exposed to significant losses. However, navigating these risks with a clear strategy and understanding of the sports industry can offer investors ample opportunities for successful returns.

Understanding Key Factors of Investing in the Sports Industry

The sports industry is a dynamic and ever-changing landscape, filled with exciting opportunities for savvy investors. Understanding the key factors behind successful sports investments can be the difference between striking gold and missing the mark. From identifying emerging trends in the market to assessing risk and measuring potential returns, there are numerous critical factors to consider when investing in this industry. With the right knowledge and expertise, however, investing in sports can be both rewarding and lucrative. Whether you’re a seasoned investor or just starting, doing your homework and understanding the ins and outs of the sports industry is crucial to achieving success in this exciting field.

Building a Balanced and Diversified Portfolio

As with any investment, building a balanced and diversified portfolio in the sports industry requires careful consideration and thoughtful planning. This means not only investing in popular and established sports such as football or basketball but also exploring emerging sports like esports or extreme sports. It’s also crucial to diversify across various segments of the industry, including media rights, sponsorships, and merchandise sales. But it’s not just about diversification; it’s also about finding the right balance. Allocating resources appropriately based on risk tolerance and investment objectives is key to maximizing returns while minimizing downside risk. By taking a strategic and disciplined approach, investors can capture the full potential of this exciting and rapidly growing market.

Evaluating Long-Term and Short-Term Investment Strategies

In the world of business, investing is an integral part of financial planning. While it may seem tempting to focus solely on short-term investment strategies, evaluating both long-term and short-term options is crucial for creating a successful investment portfolio. Long-term investments offer the advantage of generating substantial returns over a prolonged period, giving investors a chance to build substantial wealth over time. On the other hand, short-term investments provide quick returns that can be used to fund immediate expenses or reinvest in other opportunities. By thoroughly reviewing all available investment options, businesses can make informed choices that will help them achieve their financial goals.

Identifying Professional Advisors to Guide Your Investments

When it comes to managing your investments, it can be overwhelming to navigate the vast amount of information and options available. That’s why it’s crucial to seek the guidance of professional advisors who have the expertise and experience to help you make informed decisions. But not all advisors are created equal, so how do you identify the right ones? Look for those who are licensed and registered, have a good reputation within the industry, and are transparent about their methods and fees. You should also consider their level of specialized knowledge in the areas you need assistance with, whether it be tax planning, estate planning, or risk management. With the right professional advisors by your side, you can feel confident in your investment decisions and potentially reap the rewards for years to come.

Investing in the sports industry can be a lucrative opportunity when done right, but it is important to understand the variables involved and develop an investing strategy that accompanies risk with reward. Following these steps will help you make meaningful investments in the sports industry that will generate a satisfactory return for your portfolio. It all depends on taking the necessary precautions to ensure that proper investments are made, which will create greater returns for years to come.